The True Cost of Buying vs. Renting (Calculator Inside)

We’ve all been there. Standing in Home Depot, staring at a $300 pressure washer, doing mental gymnastics to justify the purchase. “I’ll use it twice a year… for the next 10 years… that’s 20 uses… so really it’s only $15 per use…”

Stop. Let’s do the real math.

The Hidden Costs Nobody Talks About

When you buy something, the price tag is just the beginning. The true cost of ownership includes:

- Purchase Price – The obvious one

- Storage Cost – The space it takes up

- Maintenance – Keeping it functional

- Depreciation – It loses value immediately

- Opportunity Cost – What else that money could do

- Disposal Cost – Getting rid of it eventually

- Mental Cost – The stress of owning more stuff

Most people only consider the purchase price. That’s why garages are full of regrettable purchases.

Let’s Run the Numbers

Example 1: The Pressure Washer

Buying:

- Purchase price: $300

- Storage (1 sq ft x $10/sq ft/year x 5 years): $50

- Maintenance (cleaning, winterizing): $20/year x 5 years = $100

- Depreciation (worth $50 after 5 years): $250 loss

- Total 5-year cost: $700

- Uses over 5 years: 10 (twice per year)

- Actual cost per use: $70

Renting:

- Rental cost: $30/day

- Total 5-year cost: $300 (10 uses)

- Cost per use: $30

- Savings: $400 (57% less)

Example 2: Camping Gear Set

Buying:

- Complete setup: $1,200

- Storage (closet space): $100/year x 5 years = $500

- Maintenance/replacement: $200

- Depreciation: $600

- Total 5-year cost: $2,500

- Annual camping trips: 1

- Cost per trip: $500

Renting:

- Rental cost: $100/weekend

- Total 5-year cost: $500

- Cost per trip: $100

- Savings: $2,000 (80% less)

Example 3: Tile Saw (One-Time Project)

Buying:

- Purchase price: $800

- Used for one bathroom renovation

- Resale value: $400 (if you bother to sell it)

- Storage for years: $200

- Total cost: $600 minimum

Renting:

- Rental cost: $60/day x 3 days

- Total cost: $180

- Savings: $420 (70% less)

The Rent vs. Buy Calculator

Use this simple formula to decide:

Annual Cost of Ownership = (Purchase Price + Storage + Maintenance) ÷ Years of Use

Annual Cost of Renting = Rental Price x Number of Annual Uses

If Renting < Ownership, rent it.

Quick Reference Guide

| Item | Buy If You Use | Rent If You Use |

|---|---|---|

| Power Tools | Weekly | Monthly or less |

| Pressure Washer | Weekly | Few times/year |

| Ladder | Monthly | Few times/year |

| Camping Gear | Monthly | 1-2 times/year |

| Party Supplies | Monthly | Few times/year |

| Specialty Tools | Weekly | Once or rarely |

The “But What If” Syndrome

“But what if I need it suddenly?” Reality: P2P rentals are often available same-day in your neighborhood.

“But what if I use it more than expected?” Reality: You can always buy later if usage increases. You can’t un-buy something.

“But what if rental prices go up?” Reality: Ownership costs also increase (maintenance, storage, depreciation).

“But I like owning things.” Reality: Do you like owning things, or do you like having access to things?

The Space Cost Nobody Calculates

The average American home is 2,300 sq ft, costing $150/sq ft. That’s $345,000, with 25% (575 sq ft) used for storage. That means:

- $86,250 of your home value is storage

- $450/month of your mortgage is for storing stuff

- $5,400/year to store things you rarely use

Every item you don’t buy is space you reclaim.

The Opportunity Cost Is Real

That $300 pressure washer could instead be:

- Invested at 7% return: $420 after 5 years

- 10 rentals of different tools you actually need

- 3 months of gym membership

- Nice dinners out

- Down payment savings growing

Money tied up in unused items is money not working for you.

Environmental Cost Comparison

Buying:

- 55 lbs CO2 from manufacturing

- Packaging waste

- Eventual disposal

- Resource extraction

Renting:

- Shared resource = divided impact

- 80% reduction in manufacturing needs

- Extended product lifespan

- Circular economy contribution

The Psychology of Smart Renting

Renting isn’t about being cheap. It’s about being smart. Consider:

The Millionaire Mindset

Wealthy people often rent because they understand:

- Capital efficiency

- Opportunity cost

- Depreciation reality

- Access over ownership

The Minimalist Advantage

Less stuff means:

- Less stress

- More mobility

- Clearer spaces

- Focused spending

The Community Benefit

When you rent from neighbors:

- Money stays local

- Relationships build

- Resources optimize

- Everyone wins

When Buying Makes Sense

Let’s be clear – buying makes sense when:

- You use it weekly or more

- It’s essential for work

- Rental availability is poor

- The rental/buy ratio exceeds 10:1

But for occasional use items? The math is clear.

Your Savings Action Plan

Ready to start saving? Here’s your roadmap:

- Audit Your Stuff: List items used less than monthly last year

- Calculate True Cost: Use our formula for each item

- Research Rental Options: Check local P2P platforms

- Start Small: Try renting one thing next time

- Track Savings: Document what you save

- Invest the Difference: Put savings to work

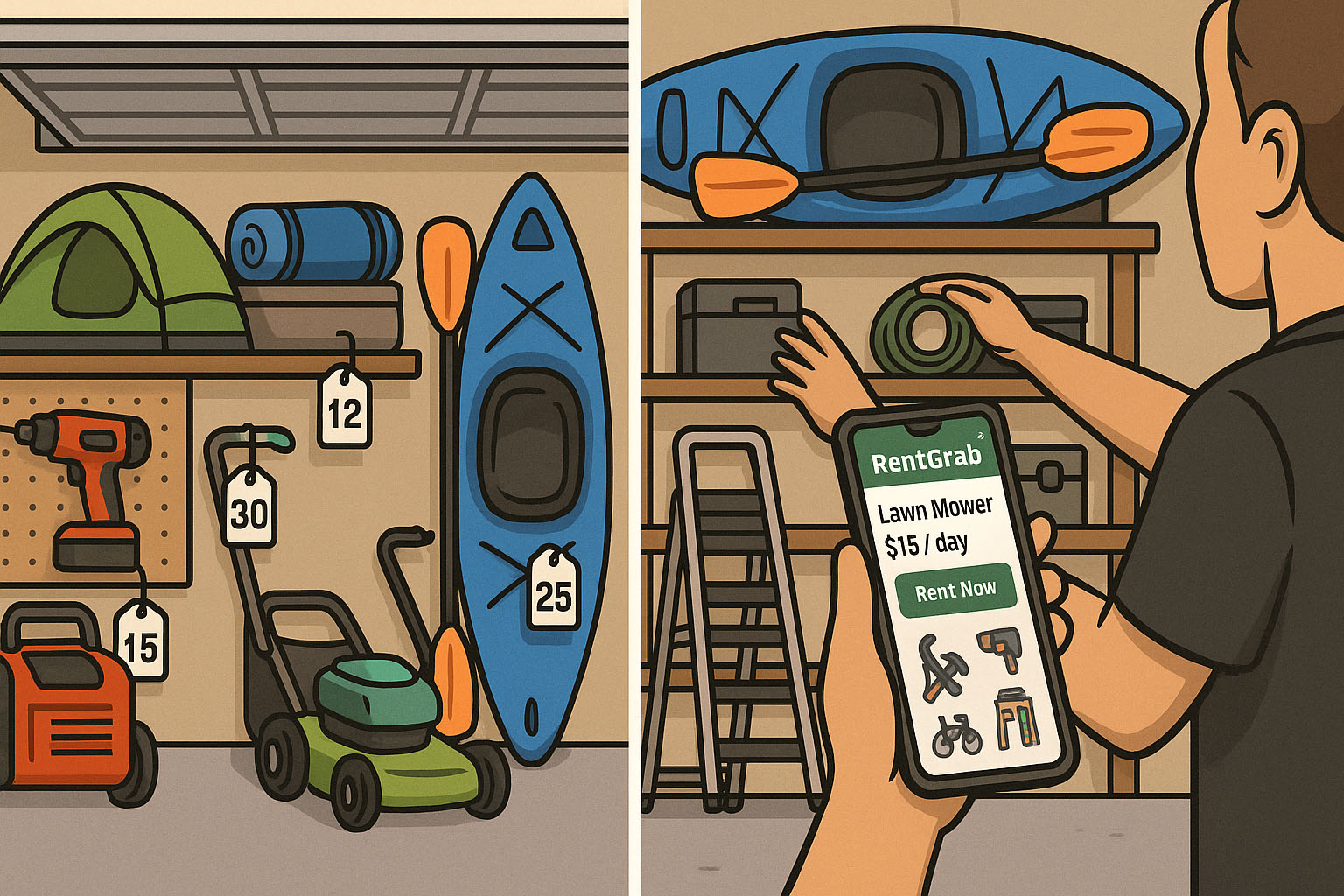

The RentGrab Solution

RentGrab will connect you with neighbors who have what you need. Our platform will make it easy to:

- Find items in your neighborhood

- Rent safely with verified users

- Save money on occasional-use items

- Make money from your unused stuff

- Build community connections

Be among the first to discover the smart way to access what you need without the burden of ownership.

Start Saving Today

The choice is clear. For occasional-use items, renting saves money, space, and stress. Every rental is:

- Money in your pocket

- Space in your home

- Less environmental impact

- Stronger community connections

Ready to make the switch? Get ready for RentGrab and prepare to start your journey to smarter spending.

Calculate your savings. Rent smarter. Live better.

Tagged with:

Get the latest rental insights

Subscribe to our newsletter for equipment rental tips, industry news, and exclusive offers.

Join the waitlist and get:

- ✓ 3 months free premium features ($147 value)

- ✓ Founding member badge

- ✓ First access when we launch

- ✓ Insider tips and early bird specials

We respect your privacy. Unsubscribe at any time.

Related Articles

The True Cost of Buying vs. Renting (Calculator Inside)

Break down the real economics of ownership versus access. Use our calculator to see how much you could save by renting instead of buying occasional-use items.

What RentGrab Actually Is (And Why It Matters)

RentGrab is a neighborhood marketplace where you rent what you need and earn from what you own. Here's exactly how it works.

The $3,000 Problem Hiding in Your Garage

Discover how much value is sitting unused in your home and how the sharing economy can turn your idle items into a profitable side income stream.